Fax: 07 5452 7301

Email: nathan@ffsolutions.com.au

Latest News

Volatile markets underscore importance of discipline Heightened volatility and market losses early in 2022 emphasize the value for investors of a long- term focus.

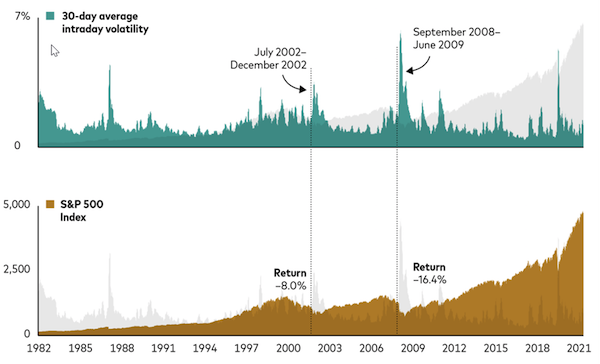

Written by Greg Davis, Vanguard Chief Investment Officer At Vanguard, we've always emphasized the importance of investing for the long term. The example of two recent U.S. equity market trading days helps reinforce that message. On January 20, the markets rose solidly throughout the day, with the Nasdaq, best-known for technology stocks, up nearly 2% at its highest point. But the gains evaporated in a flurry of late selling. Just two business days later, on January 24, the situation presented itself in reverse. The Standard & Poor's 500 Index of the largest U.S. companies was down by as much as 4% yet finished in positive territory after a late-day surge. Anyone who hadn't paid attention to the wild swings may have thought that stocks' daily movements were unremarkable. We've always believed that, for long-term investors, not paying attention to the day-to-day is a wise strategy. Several factors suggest more volatility aheadIt hasn't been possible, of course, to avoid the developments that have so roiled the financial markets in 2022. Two of the biggest—accelerating inflation and a pandemic that just won't quit—we're living with every day. Throw in a Federal Reserve that we believe will need to act decisively to contain inflation, as Vanguard's global chief economist, Joe Davis, recently wrote, and it's not hard to imagine more volatility ahead, along with the potential for losses in a stock market that low interest rates have fueled. But it remains possible to maintain perspective through understanding history. Volatility, as the illustration shows, is a constant that tends to spike when stock markets endure valleys. A history of volatility and long-term gains

Notes: Intraday volatility is calculated as the daily range of trading prices ([high-low]/opening price) for the S&P 500 Index. Periods of extended volatility above historical averages have at times resulted in sharp losses during the period, as shown. The index value has also risen during periods of extended high volatility. Sources: Vanguard calculations, using data from Refinitiv Datastream through January 21, 2022. Data accessed on January 24, 2022. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. What investors should keep sight of is that, over time, these inevitable valleys have given way to higher peaks. It's why we continue to invest to finance our long-term goals, such as retirement. And it should be our goals that govern our approach to investing. These goals, as Vanguard's principles for investing success emphasize, should be built on realistic assumptions for investing returns. A time to embrace balance and discipline The Vanguard Economic and Market Outlook for 2022 notes our guarded, though not bearish, long-term equity return outlooks. The course of the year ahead will be influenced by how policymakers remove from still-growing economies the strong fiscal and monetary support that had been required to withstand the early stages of the COVID-19 pandemic. Our outlook for fixed income is more sanguine; although interest rates remain historically low, modest rises since 2020 have moved our return outlooks commensurately higher. (A recent Vanguard analysis reveals a silver lining for investors in rising interest rates.) Policymakers face a balancing act in the months ahead, one that could carry significant implications for economic growth, inflation, and investment returns. Their jobs won't be easy. Investors, meanwhile, may find their discipline challenged by markets that have approached or already entered corrections, or falls of 10% or more from recent highs. Our message for investors, as always: Maintain perspective, tune out the day-to-day noise that can lead to impulsive decisions, be true to your goals, and put your faith in a history that has rewarded those who embrace the long term.

Greg Davies |