Fax: 07 5452 7301

Email: nathan@ffsolutions.com.au

Latest News

How much money do I need to retire? When I retire, will I have enough money to enjoy the retirement lifestyle I envision? It's a question many of us will need to ponder at one point.

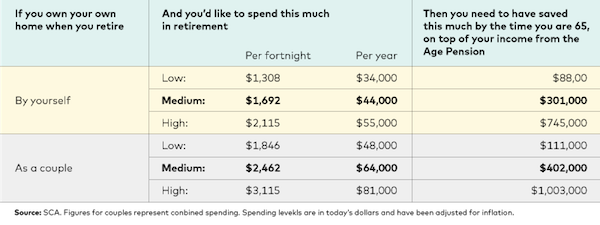

It’s a question most of us will need to ponder at some stage in our lives. When I retire, will I have enough money built up in superannuation and other savings to enjoy the sort of retirement lifestyle I want to have? Working out how much superannuation you’ll have by the time you reach your intended retirement age is fairly easy. There are lots of online retirement calculators that will do that for you once you enter in some basic personal information. But these calculators have obvious limitations. They can’t accurately predict how much of your superannuation money you’re going to spend when you do retire, or how much income your accumulated savings will deliver. New retirement savings researchThat’s where some research released this month by Super Consumers Australia (SCA) attempts to provide some estimates. It’s calculated a range of superannuation savings targets based on what individuals or couples expect they’ll need to spend once they do retire. The assumptions assume you own your home outright by the time you retire, or don’t pay rent, and that you also receive a portion of the government Age Pension to supplement your superannuation savings income. calculations are broken down into three retirement spending bands (low, medium, and high). For example, it calculates that an individual wanting (or needing) to spend $44,000 per year will need $301,000 in savings by the time they reach age 65. research is a general guide, and it requires individuals or couples to work out how much they’d like to spend in addition to any entitlement they have to receive the Age Pension. Not everyone can qualify for the Age Pension. Whether you do or don’t depends on how much money and investments you have (outside of your home) and whether you earn additional income. To find out more, you can check both the “assets test” and the “income test” on the federal government’s Services Australia website. Currently, eligible individuals can receive up to $987.60 per fortnight ($25,678 per year) in Age Pension payments. Couples can receive up to $744.40 each per fortnight ($38,709 per year). Savings targets for pre-retirees, aged 55-59

Comparing with other dataThe Association of Superannuation Funds of Australia’s Retirement Standard approaches retirement savings from a different angle, based on how much it estimates you’ll need to generate in income annually to live your preferred retirement lifestyle It benchmarks quarterly the minimum annual cost of a comfortable or modest standard of living in retirement for singles and couples. As at the end of the March 2022 quarter, it calculated that based on the cost of living a single person needed $46,494 a year to live a comfortable retirement and a couple needed $65,445. To live a modest retirement, a single needed $29,632 a year and a couple $42,621. The above figures don’t differentiate between whether the money you need per year comes from your superannuation savings, other investments, the Age Pension, or a combination. At ASFA’s top level, to achieve a comfortable standard of living ($46,494 per year), a single person eligible for the full Age Pension ($25,678 per year) would need be able to generate around $20,000 per year from other investments. Likewise, a couple eligible for the full $38,709 in Age Pension would need to generate around $27,000 per year from other investments to achieve a comfortable living standard based on $65,445 per year. How you can do that ultimately comes down to your overall investment strategy, especially after you retire. Keep in mind that any income earned on money you hold in superannuation, once it’s converted into an account-based pension, will be tax-free in retirement. Staying financially activeTaking an active role in your investments, to ensure you have the best chance of protecting and growing your capital, is just as important in retirement as it is before you stop working. For many retirees, low-risk assets such as cash and government-backed bonds are often seen as the safest ways of protecting capital over the long term. Yet, depending on your broad retirement goals and tolerance for risk, putting all your eggs into one or two asset classes will most likely expose you to investment hazards over the long term. That’s because asset classes perform differently from year to year. What you may see as a safe investment strategy today could easily become the opposite over time. Investing across a range of asset classes during pension drawdown phase, including more volatile growth assets such as shares and listed property, will help smooth out poor returns from other asset classes from year to year. While there’s no guarantee your retirement savings will last until you die, a diversified investment strategy will inevitably deliver steadier, tax-effective long-term returns.

Tony Kaye |